what is the inheritance tax in georgia

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation.

Guide To Georgia Inheritance Law The Law Office Of Paul Black

No estate tax or inheritance tax.

. A few states have disclosed exemption limits for. Inheritance of third and fourth degree relatives are taxed at 20 on their inheritance. The top estate tax rate is 16 percent exemption threshold.

The tax is paid by the estate before any assets are distributed to heirs. No estate tax or inheritance tax. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

Inheritance Tax Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. The tax is paid by the estate before any assets are distributed to heirs.

The tax is paid by the estate before any assets are distributed to heirs. The tax is paid by the estate before any assets are distributed to heirs. The tax is paid by the estate before any assets are distributed to heirs.

No estate tax or inheritance tax. It is not paid by the person. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. The top estate tax rate is 16 percent exemption threshold. Georgians are only accountable for federally-mandated estate taxes.

No Georgia does not have an inheritance tax. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. State inheritance tax rates range from 1 up to 16.

No estate tax or inheritance tax. There is no federal inheritance tax but there is a federal estate tax. First and second degree relatives are fully exempt from inheritance taxes.

However the federal exemption equivalent was 3500000 for 2009 5000000 for 2010 and 2011 and 5120000. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current fairly high. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. It is not paid by the person.

Georgia does not have any inheritance tax or estate tax for 2012. The exact federal rules depend on the year in which your parent died.

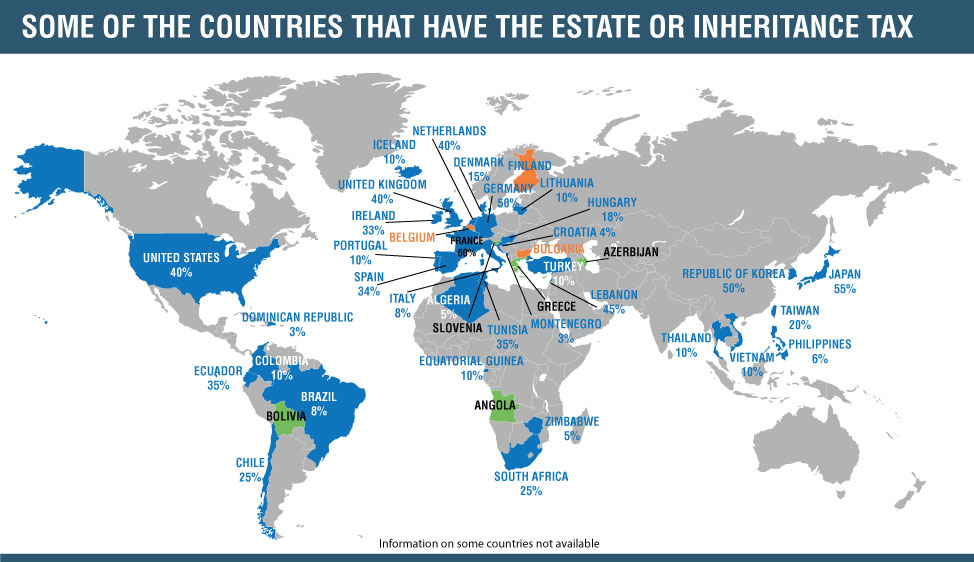

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Farmers Cry Foul Over Biden S Death Tax Proposal The Georgia Virtue

Georgia Health Legal And End Of Life Resources Everplans

Taxation In Georgia No More Tax

State Estate And Inheritance Taxes Itep

South Carolina Vs Georgia Which Is The Better State

State By State Estate And Inheritance Tax Rates Everplans

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Guide To Selling An Inherited Home In Atlanta Georgia Breyer Home Buyers

Georgia School Laws Lexisnexis Store

Georgia Estate Law Faulkner Law

Estate Planning Attorneys In Atlanta Ga Best Estate Planning Lawyers In Atlanta

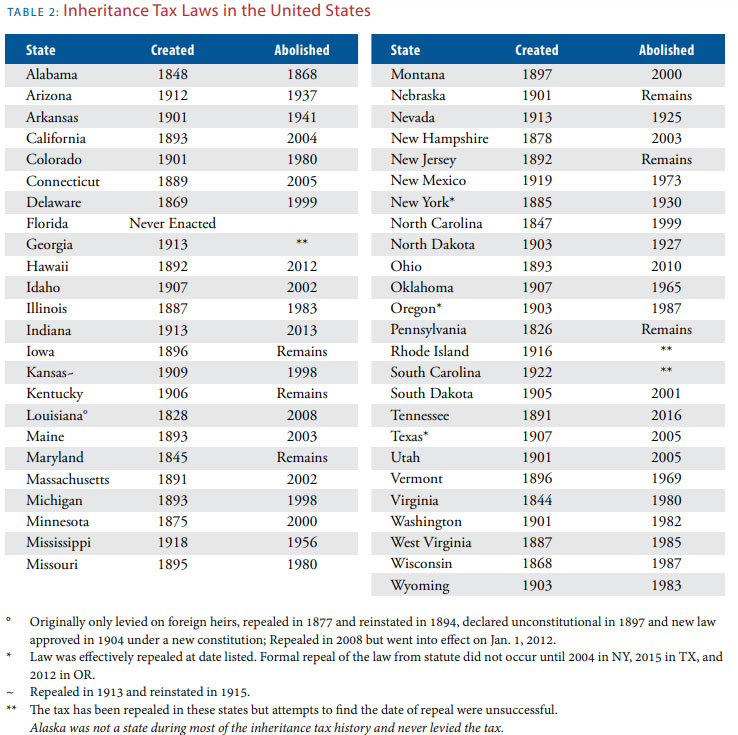

Death And Taxes Nebraska S Inheritance Tax

State Tax Levels In The United States Wikipedia

Where Not To Die In 2022 The Greediest Death Tax States

Georgia Taxation Of International Executives Kpmg Global

Is Taxation Low In Georgia Full Guide For Entrepreneurs